Accounting fundamentals for Techies

This post is answer of reader's query which was pending from long time.

So...What Are Commitments?

So...What Are Commitments?

Commitments are obligations for future expenditures made , and this should be for an employee or vendor PO's. Commitments are tracked to help departments forecast their expenditures so that they do not exceed their budget available.

Oracle Vanilla encumbrance accounting -Briefing

Oracle Vanilla encumbrance accounting -Briefing

Basic Oracle Process

Basic Oracle Process

Oracle Product associated with encumbrance

Oracle Product associated with encumbrance

Why Is Cash So Important?"

Why Is Cash So Important?"

Cash Flow & Accrual method of accounting

Cash Flow & Accrual method of accounting

..that mean ...Cash Flow Statement

..that mean ...Cash Flow Statement

Why do we need CFS as financial reporting?

Why do we need CFS as financial reporting?

Do you know ..What is Float?

Do you know ..What is Float?

Statements of Cash Flow

Statements of Cash Flow

Its all about Relation ship

Its all about Relation ship

CASH FLOW CLASSIFICATIONS- Activities Affecting Cash

CASH FLOW CLASSIFICATIONS- Activities Affecting Cash

Operating Activities

Operating Activities

Investing Activities

Investing Activities

Financing Activities

Financing Activities

How To Develop an Accurate Initial Cash Flow Projection

How To Develop an Accurate Initial Cash Flow Projection

Developing a Cash Flow Statement

Developing a Cash Flow Statement

Do you know Who can utilize information processed by the SCF?

Do you know Who can utilize information processed by the SCF?

Cash Flow Statement in Oracle Financials?

Cash Flow Statement in Oracle Financials?

Profit and Loss A/C

Profit and Loss A/C

Profit and Loss A/c Concept

Profit and Loss A/c Concept

Balance sheet and P&L- Driven by Transaction

Balance sheet and P&L- Driven by Transaction

Why Balance Sheet Required?

Why Balance Sheet Required?

Balance sheet - techies definition

Balance sheet - techies definition

Do this have any Structure?

Do this have any Structure?

Is there any limitation for Balance sheet?

Is there any limitation for Balance sheet?

Where is my Balance sheet report within Oracle

Where is my Balance sheet report within Oracle

What is IFRS?

What is IFRS?

What is meant IFRS for Oracle eBusiness consultant/ERP Consultant?

What is meant IFRS for Oracle eBusiness consultant/ERP Consultant?

IFRS - What it is for?

IFRS - What it is for?

IFRS - What it is not for?

IFRS - What it is not for?

IFRS – How new is it?

IFRS – How new is it?

US GAAP vs. IFRS - A difference

US GAAP vs. IFRS - A difference

Don’t worry about your ERP Side

Don’t worry about your ERP Side

Some more from Oracle blog

Some more from Oracle blog

Definition of Netting

Definition of Netting

Benefits of Netting

Benefits of Netting

Types of Netting

Types of Netting

Payment Netting

Payment Netting

Novation Netting

Novation Netting

A Payment Netting vs Novation Netting

A Payment Netting vs Novation Netting

Close-Out Netting

Close-Out Netting

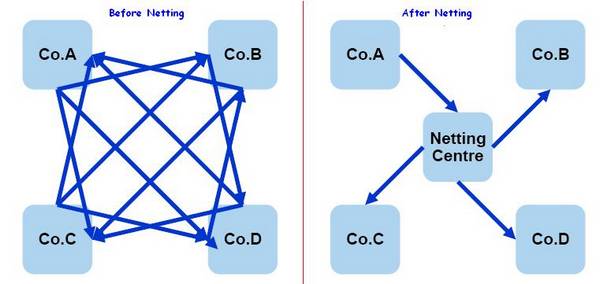

Multilateral Netting

Multilateral Netting

Requirement Mapping with Existing Oracle EBS Product

Requirement Mapping with Existing Oracle EBS Product

Cash Basis Accounting

Cash Basis Accounting

This is what "Based on Realization"

Accrual Basis AccountingThis is what "Based on Recognition"

Accrual Basis AccountingThis is what "Based on Recognition"

To elaborate in details , lets take sample case with two items.

Accounting fundamentals for Techies : Encumbrance

Before start of this topic you should be clear on these term;

- Encumbrance

This is your any pre-expenditure, such as a purchase order, which will lead to a charge against an account. - CommitmentA journal entry you make to record an anticipated expenditure, as indicated by approval of a requisition.

- Obligation

An encumbrance you record when you turn a requisition into a purchase order.

Commitments are obligations for future expenditures made , and this should be for an employee or vendor PO's. Commitments are tracked to help departments forecast their expenditures so that they do not exceed their budget available.

If you are using encumbrance you can get answer of these two question.

- How much do I have left to spend?

- Alert me if spending too much from allocated budget.

How much I left to spend , will be based out of these formula

Funds Available = Budget - Actual - Encumbrances.

budget is always unaltered, Encumbrances is reversed when matching to AP invoice.

Oracle encumbrance accounting feature is supported by a process called funds reservation, which is implemented in the General Ledger as a user-exit or spawned program.

What is required if enabled Purchase Orders and Purchase Requisitions to first undergo a funds check when they are submitted. The system checks the line amount(s) of the requested purchase against the budget for the GL account(s) and alerts the user if that PO or Req. will exceed the funds on the account.This process of verification of available funds based on pre-defined summary templates.

Journals are then recorded in a special table called GL_BC_PACKETS, where they will sit temporarily before being converted by a concurrent process called “Program – Create journal” into permanent encumbrance journals.

The modules capable of initiating such transactions are the purchasing module for the creation of three documents, Standard Purchase Order, Requisition and Purchase Order Releases and the Accounts Payable module for the different invoices. It is possible to control the type of encumbrance created by these modules via the set-up of the applications.

The benefit of the encumbrance accounting feature is the ability to have the system control the expenditure budget from the General Ledger, reducing the risks of potential over expenditure.

This is often a legislated requirement for public organizations.

The transactional flow has funds reservation being performed through the GL_BC_PACKETS table when reserving funds for purchasing documents, and through the GL_INTERFACE table for receipt accruals which can be either On Receipt or at Period End. The funds checker process takes place whenever funds reservation and/or adjustment is made.

After transactions have taken place in Purchasing, it will become necessary to run the Create Journals program in GL. This program essentially sweeps through the GL_BC_PACKETS table and creates journals for the entries as entered.

Essentially this process allows the different manager to understand their “funds available” based on the following formula.

Funds Available = Budget – Actual – Encumbrance

The Oracle system has the ability to control this formula per fiscal period using the different balances tracked within GL_BALANCES (Essentially the General Ledger) by PTD (Period To Date), QTD (Quarter To Date), YTD (Year To Date),PJTD (Project To Date).

If you are coming from other Products like SAP or SUN , let clear these two terms in Oracle context in Project module specific.

- Actual Transactions - Actual transactions are recorded project costs. Which may includes labor, expense report, usage, burden, and miscellaneous costs.

- Commitment Transactions - Commitment transactions are anticipated project costs. Such examples include purchase requisitions and purchase orders or contract commitments.

The basic process flow for encumbrance accounting activity related to Oracle Purchasing typically is as follows:

- Create a requisition.

- Approve and reserve funds for the requisition.

- AutoCreate requisition onto a purchase order.

- Approve and reserve PO (which automatically reverses the requisition funds reservation)

- Receive against the purchase order (either period-end or online accruals) and the funds are reversed for the amount received and entered against the charge account.

Take a note, funds reversal also occur when documents are cancelled or finally closed.

Requisitions, when autocreated onto a purchase order, have their funds reversed either when the PO is approved and reserved or when the requisition line(s) are rejected or returned.

- General Ledger

- Purchasing

- Payables

- Projects

- Grants

Next will see Accounting Treatment in encumbrance.

Understanding “Cash Flow Statement”

Lets start with the basic concept ;

Cash is the necessary element which runs the business. We need to know where the cash comes from (sources, or inflows) and where it is spent (uses or outflows).

- Most of bills, Salaries, etc are paid in cash

- Most vendors are paid in cash

- Even on a “good day,†the small business will owe its debts in 30 days

- Those purchasing products/services from the small business though will have 90 days to pay their debts.

What is Cash Flow?

- CF Statement is a 'flow' statement.

- CF Statement indicates changes that took place between tow successive Balance Sheets.

- The statement of cash flows provides a thorough explanation of the changes that occurred in a firm's cash balance during the entire accounting period.

- The statement of cash flows reports cash receipts and payments of a company during a given period for operating, financing, and investing activities.

- Cash includes cash and cash equivalents.

Cash Flows, although related to net income, are not same. This is because of the accrual methodof accounting. As we know,under accrual accounting, a transaction is recognized on the income statement when the earnings process is completed, that is , when the goods and /or services have been delivered or performed or an expense has been incurred.

- Cash flow statements ARE NOT budgets

- Cash flow statements are concerned only with ACTUAL cash inflows and outflows .

An Example of the Difference Between Budgets and Cash FlowsIf you take a “Prepaid insurance†for a year costing $3,000 – or $250 a month

- A budget will account for 12 equal installments of $250

- A cash flow statement will recognize a 1-time only outflow of $3,000.

- You can also see more details inflows and Outflows attributes at the end.

- Balance Sheet & P&L A/c is not sufficient in term of pure financial Reporting.

- It shows the relationship of net income to changes in cash balances.

- It reports past cash flows as an aid to:

- Predicting future cash flows

- Evaluating the way management generates and uses cash

- Determining a company's ability to pay interest and dividends and to pay debts when they are due

- It identifies changes in the mix of productive assets.

- The statement of cash flows, along with the income statement, explains why balance sheet items have changed during the period.

- Some time , there is legal rules to provide the cash Flow statement.

Float refers to the difference in time between when the check is deposited and cash is received.

This makes a significant impact of your CFS.

A statement of cash flow is one of several financial statements that public companies construct and share with their stake holders. In general this statement will include a formula or calculation that considers:

Cash and Cash Equivalents (Beginning)

+ Cash from Operations

- Cash Flows from Investing Activities

+ Cash Flows from Financing Activities

= Cash and Cash Equivalents (Ending)

This is family pack of financial reporting. The relationship among the balance sheet, income statement, and statement of cash flows:

Cash Activities are divided into three main categories

- Operating activities - transactions that affect the income statement ..these are mostly used for Normal day-to-day activities

- Cash effects of revenue and expense transactions

- Deal with the income statement accounts

- Included interest paid (on debt) and income taxes (to the government) which enters in the determination of net income

- Cash receipts from sales of good and services,miscellaneous income

- Cash payments for inventory, wages, insurance, utilities,rent

- Changes in current asset and liability accounts from the prior year.

- Investing activities - activities that involve (1) providing and collecting cash as a lender or as an owner of securities and (2) acquiring and disposing of plant, property, equipment, and other long-term productive assets ...like changes in long term assets and investment

- Financing activities - activities that include obtaining resources as a borrower or issuer of securities and repaying creditors and owners..and these are basically changes in equity and non Operating Liabilities

Cash Inflows are typically Understood as

- Cash Receipts from sale of goods/rendering of services

- Cash Received from royalties, fees, commission, etc.

- Other operating receipts

where the cash outflow can be best understood as:

- Cash payments to suppliers for Goods/services

- Cash payments to employees

- Interest and taxes paid

- Other operating cash payments

Cash Inflows are typically Understood as

- Sale of property, plant, and equipment

- Sale of securities that are not cash equivalents

- Receipt of loan repayments

where the cash outflow can be best understood as:

- Purchase of property, plant, equipment

- Purchase of securities that are not cash equivalents

- Making loans

Cash Inflows are typically Understood as

- Borrowing cash from creditors

- Issuing equity shares

- Issuing debt securities

where the cash outflow can be best understood as:

- Repayment of amounts borrowed

- Repurchase of equity shares

- Payment of dividends

- Contact vendors/suppliers and ask about payment terms

- Check with credit card companies and get information about when the accounts will be processed as well as what the percentages are.

- The cash flow statement of a small business is different than that of a corporation

- Corporation will have operating, investing, and financing sections to their Statement of Cash Flows

- The small business is only interested in the cash flows resulting from operations

- Operations signifies all the cash flows in/out of the business…

- A cash flow statement will maintain an accurate representation of the overall cash position if used effectively

- A cash flow statement begins with expenses

Examples of possible expenses- Salaries

- Cost of Goods Sold

- Taxes

- Office Supplies (often underestimated)

- Rent

- Most important to account for EVERY expense…you have defined in system.

- Begin accounting for revenues once done with all expenses

- If possible, the company should separate their revenues into separate categories

It will help focus the business on which sectors of its revenues are important and will influence the operations of the business…

These is utilized by Management,Investors

- Important to know, there is no seeded report that cater the need for Cash Flow.

- Most of cash flow statement is prepared by account department.

- We can achieve CFS by using OFA.

- We can also generate CFS by FSG, but it is bit difficult, unless until, the format is not very simple.

- you can pull the reports based out of data in the GL_BALANCES table.

Understanding “Profit and Loss (P&L)” from Techies Mind

- In accounting world, an Income Statement is called as "Profit and Loss Report". In addition, the word Revenue is often used in place of the word Income. An Income Statement is used to inform you about the income earned, expenses incurred, and the total profit or loss in a particular period. Two common periods for creating an income statement are monthly and annually.

- This report summarizes all Income (or sales), the amounts that have been or will be received from customers for goods delivered or services rendered to them, and all expenses, the costs that have arisen in generating revenues.

- Normally Income Accounts accounts are used to track income earned during the process of operating your business. The income of a business comes from sales to customers or fees for services or both. Some of the common names for income accounts are: Income from Sales, Income from Freight, Income from misc. sources as property, shares.

- As discussed in last post Balance Sheet is a ‘position’ statement whereas Profit & Loss Account is a ‘flow’ statement.

- The need of P & L report is enforced because of companies Act, which enforce to produce Balance sheet and P&L account.

- A Balance Sheet as on the last day of the financial year

- A Profit & Loss Account for the financial year.

What you suppose to remeber is :

- P&L A/c is also called ‘Income Statement’.

- Income is calculated as the difference between revenues and expenses.

- Revenues: from operations

- Expenses: specific product/service/period

- Accountants have agreed to use the accrual basis of accounting rather than the cash basis

The term Revenue and expense

- Revenues - gross increases in owners’ equity arising from business operations/delivery goods-services to customers

- Expenses - decreases in owners’ equity that arise because goods or services are delivered to customers

In term of accounting, this can be described as:

Revenue Account :This is the income account. Whenever a revenue account balance is changed, it leads to a change in the Assets / Liabilities account. Revenue account is not a control account, it’s treated as an operative account. At the beginning of a new accounting cycle, this account is turned to zero. Entire balance is transferred to the retained earnings account.

Expense Account : This is the operations expenditure account. Whenever an expenditure account balance is changed, it leads to a change in the Assets / Liabilities account. This account behaves just like the Owner’s equity account as an increase in this account essentially means a decrease in owner’s equity. Expense account is not a control account, it’s treated as an operative account. At the beginning of a new accounting cycle, this account is turned to zero. Entire balance is transferred to the retained earnings account.

Spliting the above , the balance sheet can be drived on the basis of these. You can see the details in one of last post.where as Profit and Loss report can be best build and understand as:

Profit and Loss can be based out of these basic concept as discussed in one of my post .

ACCOUNTING PERIOD

- Expenditure during A/c period which are also expenses of that period.

- Expenditure during the A/c period which will become expense only in future periods

- Expenditure during the previous A/c period which will become expenses during the current A/c period

- Expense of the current A/c period which have not yet been paid

REALIZATION CONCEPT

What is important here is

- ‘point of time’ or revenues earned

- recognition of revenues

ACCRUAL CONCEPT

Normally companies measure there profits by change in Owners’ equity , revenues increases OE, expenses decreases OEMATCHING EXPENSES WITH REVENUE

- Revenues - Expenses = Profit

- Retained earnings - additional owners’ equity generated by income or profits

- Revenues increase owners’ equity.

- Expenses decrease owners’ equity.

In last post we have seen BS provides a snapshot of an entity’s financial position at an instant in time., where as P&L A/c provides a moving picture of events over a span of time and explains the changes that have taken place between BS dates. This can be best described as below figure.

Understanding “Balance Sheet” from Techies Mind

Do you know one of Key Financial Report aka Balance Sheet is a basically ‘position’ statement, which describes the financial position of assets & liabilities of

- your company/firm

- as on a particular date

If you take any accounting book, this can be best defined as "a statement of the financial position of an enterprise as at a given date, which exhibits assets, liabilities, capital, etc."

Obvious question why this is required? the Only reason is because the the legal rules (Companies Act) enforce companies to publish such report.

- A Balance Sheet as on the last day of the financial year

- A Profit & Loss Account for the financial year.

In accounting world , balance sheet should reflect ‘true and fair view’ in term ofshareholder equity .

Assets and Liabilities are continuously changing with Business activity. To understand the financial position of the Business, it is necessary to ‘FREEZE’ the values of financial components at a certain point in time. These values, or Balances, are used to construct a balance sheet which shows how the owner’s equity is represented by the various categories of assets and liabilities.

Yes, If you see different accounting book, we will find two different form of Balance sheet,

- Horizontal

- Vertical

The only difference between these two are required to give the corresponding amounts for the preceding financial year (‘Comparatives’) for all the items shown in the balance sheet.

A typical Balance sheet can be best represented as:

This is based out of accounting equation, which I have discussed in one of old post :

Assets = Owner’s Equity + Outside Liabilities

A = OE + OL

in the world of double entry system, the rule of thumb is "In the double-entry accounting system, every transaction is recorded by equal amounts of debits and credits"

A (DEBIT)= OE + OL(CREDIT)

If you analyze the above sheet in term of accounting equation , this can be best understood as:

Yes, there are (adopted from Jep Robertson Notes)

- As most most assets and liabilities are based out of historical cost.

- Judgments and estimates are used in determining many of the items.

- The balance sheet does not report items that can not be objectively determined.

- It does not report information regarding off-balance sheet financing.

Balance sheet reports in Oracle are one of the FSG report which need to fine tune base out of the customer requirement, and this can be executed from the report section within GL responsibility.

A bit on IFRS

Sometime back, I was talking to one of my accountant friend who pointed me some recent changes in IFRS ,and provided some link for the awareness and to understand the impact in EBS suite. I am not going to put the details, rather will walk through some information which is good to have with ERP consultant who is dealing with Financial products.

IFRS,International Financial Reporting Standards (IFRS), together with International Accounting Standards (IAS), are a "principles-based " set of standards that establish broad rules rather than dictating specific accounting treatments. From 1973 to 2001, IAS were issued by the International Accounting Standards Committee (IASC). In April 2001 the International Accounting Standards Board (IASB) adopted all IAS and began developing new standards called IFRS.

IFRS are used in many parts of the world, including the European Union, Hong Kong, Australia, Russia, South Africa, Singapore and Pakistan. Nearly 100 countries currently require or permit the use of, or have a policy of convergence with, IFRSs. Here is list of countries which adopted IFRS.

As we are quite aware GAAP which is so called Generally Accepted Accounting P rinciples for Shareholder Reporting.The term is not drafted by a legislature.

and ,in term of Accounting Principles this can be best understood as:

IFRS = Financial Reporting standards = Balance Definitions < /FONT >

which internally means more in term of "disclosure Requirements" and "Balance Definitions " for finance controller.

The Other things IFRS would do is:

- Providing a bookkeeping rules rather many of us have impression that they have some rule set for accounting

- It will do Shareholder Reporting , and this is important when :

- A group of companies owned by a Public company

- Not the individual companies

- It will also do external reporting

- To your owners (investors, shareholders)

- Through their stock markets

- Management Reporting

- Maximize investors returns, measured only with IFRS

- Segment Reporting disclosure

And more important it should be understand that IFRS is not meant for:

- Statutory Reporting

- Tax Reporting

- Regulatory reporting

- Subsidiary reporting

- IASB has been around since 1980’s

- IAS/IFRS pretty much converged with the Americans

- If your ERP supports US GAAP, it supports IAS/IFRS

- Key premises (recognition, measurement):

- Mark to Market when possible

- Reality of the Balance Sheet – real assets, real liabilities

- Income Statement analyses the change in wealth

- Deep Disclosure: owners right to know

While looking to some more information on internet ,I discovered a nice article from the site of Fulcrum Inquiry who pointed out the key differences(adopted) between the two standards in there one of the article .

- Maybe requires some reconfiguration, maybe requires some data analysis

- We have notice there is some big change in R12 AR to meet revenue recognition, R12 is partially on track for IFRS fitness in suite.

- The new R12 Global Architecture introduced the concept of ledgers which has capability of providing differing accounting representations; one ledger for example could conform to IFRS, another to local GAAP.

- From the Currency area we have already noticed some big changes like:

- Balance level Translation or Remeasurement in Ledgers – within Ledger sets, run at one click

- Balance & Activity level Translation or Remeasurement in Financial Consolidation Hub

- Another is enhanced Revaluation [Functional Currency term dropped: conflicts with IAS 21 / FAS 52]

Those who are looking for some more insight about the changes suggested to referwhite paper mention in the last.

Keep watching this space for having some more thoughts and insight for IFRS from Oracle .

Netting : An Overview

My last two post was on netting , lot of people asked me to provide some more insight view for netting, so this post is meant to walk through ,the concept to someone not very familiar with accounting in real world...so here to go..(adopted)

When trading partners agree to offset their positions or obligations, they are netting. By doing so, they reduce a large number of individual positions or obligations to a smaller number of positions or obligations, and it is on this netted position that the two trading partners settle their outstanding obligations. Besides reducing transaction costs and communication expenses, netting is important because it reduces credit and liquidity risks, and ultimately systemic risk. For a non accounting personal risk can be best understood as :the risk of a trading partner not fulfilling his obligations in full on due date or at any time thereafter is a risk that affects all aspects of business.

In this method of reducing credit, settlement and other risks of financial contracts by aggregating (combining) two or more obligations to achieve a reduced net obligation.

- Netting rules a basic part of master agreements.

- Netting rules define precisely the netting of positions or claims between counter parties.

Netting potentially address four major risk in financial area, there are

- Reduction of credit risk

- Reduction of settlement risk

- Reduction of liquidity risk

- Reduction of systemic risk

- Payment Netting

- Novation Netting

- Close-Out Netting

- Multilateral Netting

Payment Netting

Payment Netting

Also called “Settlement Netting†or Also called "Position or Accounting Netting".

On a payment date, each party will aggregate the amounts of a currency to be delivered by it, and only the difference in the aggregate amounts will be delivered by the party with the larger aggregate obligation.

This can be best understood as:

- Daily settlement or offsetting of several, due claims in the same currency

- Reduction of transaction costs, settlement risk and liquidity risk.

- No impact on credit risk.

Types of Payment Netting Agreements

- Master Agreement with a Payment Netting Clause

- Stand-Alone Payment Netting Agreement

- Informal, “ad hoc†agreement

Novation Netting

Novation NettingIf the parties enter into a transaction which gives rise to an obligation for the same value date and in the same currency as an existing obligation, then the two obligations are cancelled and simultaneously replaced with a new obligation for the net amount.

- Settlement of not yet due claims in the same currency and the same maturity.

- Reduction of limit usage and credit risk.

Two Types of Novation Netting:

- Matched Pair Novation Netting

- “Comprehensive†Novation Netting

Matched Pair Novation NettingNetting only occurs if the two transactions involve the same pair of currencies.Example1: Matched Pair Novation NettingDeal 1: Buy JPY / Sell USD

Deal 2: Buy USD / Sell EUR

Deal 3: Buy EUR / Sell JPYNo two deals involve the same currency pair, and therefore no netting under matched pair novation netting.Example 2: Matched Pair Novation NettingExample 3: Comprehensive Novation Netting

- Payment Netting reduces settlement risk, but does achieve netting for balance sheet or regulatory capital purposes because the transactions remain in gross.

- Contrast with Novation Netting, which achieves true netting through the cancellation of offsetting transactions and their replacement with a new, net transaction.

Close-Out Netting

Close-Out NettingEffective upon a default:

- Existing transactions are terminated

- Termination values are calculated

- Termination values are netted to arrive at a single net amount

- Recourse to credit support, if any

That mean:

- Settlement/offsetting of not yet due claims in different currencies in case of a default event or an early termination event of the contractual relationship.

- All outstanding gross obligations or payments are replaced by a single obligation or payment

Multilateral Netting

Multilateral NettingBilateral Netting is between two parties.Multilateral Netting involves netting among more than two parties, using a clearing-house or central exchange.When it come to party , it may be two party interacting with third party. Th two party may be your other entity in the same instance, which do business internally, what we called Intercompany.Multilateral netting is a settlement mechanism used by companies to pay for goods and services purchased from affiliated companies. The netting process consolidates

intercompany transactions and calculates settlement requirements internally instead of using external payment systems. Netting is typically used by companies with a number of affiliates in different countries. By netting, these companies reduce bank fees, currency conversion costs, bank balances and improve operating efficiency.Will take this in some more details in another post.

Still these two processes are not fully enabled in Oracle EBS suite. Though first type of netting somehow mapped as Contra Charging in post 11i10 releases where as in R12 this functionality can be mapped as part of AP/AR netting, a new feature of R12.

Here is summarize list of the different types of netting and there corresponding netting.

Feel Free to comment or share any information.:)

Understanding Accounting from Techies Mind

Indeed, this is one of good area, where most of techies have lot of confusion and illusion about when accounting comes. Many of consultant came from Technical background and gradually moved into doing some techno -functional role or pure functional role, thus it is essestintial to understand the basic accounting and Guided principal .

Normally, there are two basic accounting methods available in the business world:

- Cash

- Accrual

And most of the ERP accounting products weather its SUN system, Oracle financial or SAP have functionality to capture on the basis of set up.

Then want is the difference:

This is what "Based on Realization"

We Most of us use the cash method to keep track of our personal financial activities.

The cash method recognizes revenue when payment is received, and recognizes expenses when cash is paid out.

For example, our local grocery store's record is based on the cash method. Expenses are recorded when cash is paid out and revenue is recorded when cash or check deposits are received

If we summarize, under the cash basis accounting, revenues and expenses are recognized as follows:

- Revenue recognition: Revenue is recognized when cash is received.

- Expense recognition: Expense is recognized when cash is paid.

Take a note the word "cash" is not meant literally - it also covers payments by check, credit card, barter, etc.

Moreover it is not standard method in compliance with accountings matching principle.

The accrual method of accounting requires that revenue be recognized and assigned to the accounting period in which it is earned. Similarly, expenses must be recognized and assigned to the accounting period in which they are incurred.

Then the underline question is what is accounting Period, Let explain like this normally a company tracks the summary of the accounting activity in time intervals, which we normally called as Accounting periods. These periods are usually a month long. It is also common for a company to create an annual statement of records. This annual period is also called a Fiscal or an Accounting Year.

In the accrual method relies on the principle of matching revenues and expenses. This principle says that the expenses for a period, which are the costs of doing business to earn income, should be compared to the revenues for the period, which are the income earned as the result of those expenses. In other words, the expenses for the period should accurately match up with the costs of producing revenue for the period.

Take a case: Company is doing a business and they have to pay sales commissions expense, so sales commissions expense should be reported in the period when the sales were made (and not reported in the period when the commissions were paid). Similarly, Salary/Wage to employees are reported as an expense in the week/month when the employees worked and not in the week/month when the employees are paid. If a company agrees to give its employees 2-month equivalent salary of its 2006 revenues as a bonus on January 25, 2007, the company should report the bonus as an expense in 2006 and the amount unpaid at December 31, 2006 as a liability. This is most simple kind of matching principal normally has.

Company is doing a business and they have to pay sales commissions expense, so sales commissions expense should be reported in the period when the sales were made (and not reported in the period when the commissions were paid). Similarly, Salary/Wage to employees are reported as an expense in the week/month when the employees worked and not in the week/month when the employees are paid. If a company agrees to give its employees 2-month equivalent salary of its 2006 revenues as a bonus on January 25, 2007, the company should report the bonus as an expense in 2006 and the amount unpaid at December 31, 2006 as a liability. This is most simple kind of matching principal normally has.

Company is doing a business and they have to pay sales commissions expense, so sales commissions expense should be reported in the period when the sales were made (and not reported in the period when the commissions were paid). Similarly, Salary/Wage to employees are reported as an expense in the week/month when the employees worked and not in the week/month when the employees are paid. If a company agrees to give its employees 2-month equivalent salary of its 2006 revenues as a bonus on January 25, 2007, the company should report the bonus as an expense in 2006 and the amount unpaid at December 31, 2006 as a liability. This is most simple kind of matching principal normally has.

Company is doing a business and they have to pay sales commissions expense, so sales commissions expense should be reported in the period when the sales were made (and not reported in the period when the commissions were paid). Similarly, Salary/Wage to employees are reported as an expense in the week/month when the employees worked and not in the week/month when the employees are paid. If a company agrees to give its employees 2-month equivalent salary of its 2006 revenues as a bonus on January 25, 2007, the company should report the bonus as an expense in 2006 and the amount unpaid at December 31, 2006 as a liability. This is most simple kind of matching principal normally has.

In general, there are two types of adjustments that need to be made at the end of the accounting period.

- The first type of adjustment arises when more expense has been recorded than was actually incurred or earned during the accounting period.

- Similarly, there may be revenue that was received but not actually earned during the accounting period. Also known as Un-earned Revenue.

The accrual method generates tax obligations before the cash has been collected (because revenue leads to tax and revenue is recognized against receivable and not against receipt of money).

If we summarize, under the accrual basis accounting, revenues and expenses are recognized as follows:

- Revenue recognition: Revenue is recognized when both of the following conditions are met:

- Revenue is earned

- i.e. when products are delivered or services are provided.

- Revenue is realized or realizable.

- i.e. either cash is received or it is reasonable to expect that cash will be received in the future.

- Revenue is earned

- Expense recognition: Expense is recognized in the period in which related revenue is recognized (Matching Principle).

Timing differences in recognizing revenues and expensesVarious accounting books did mention four potential timing differences in recognizing revenues and expenses between these of two. Just to recap of those:

a. Accrued Revenue: Revenue is recognized before cash is received.

b. Accrued Expense: Expense is recognized before cash is paid.

c. Deferred Revenue: Revenue is recognized after cash is received.

d. Deferred Expense: Expense is recognized after cash is paid.

b. Accrued Expense: Expense is recognized before cash is paid.

c. Deferred Revenue: Revenue is recognized after cash is received.

d. Deferred Expense: Expense is recognized after cash is paid.

Compare with a Case to explain these two methods

Your company purchase a new Laptop on credit in May 2007 and pay $1,500 for it in July 2007, two months later.

Under the both case see how this makes a difference:

- Using the cash method accounting, you would record a $1,500 payment for the month of July, the month when the money is actually paid.

- Under the accrual method, you would record the $1,500 payment in May, when you take the Laptop and become obligated to pay for it.

Pros and cons of these Two accounting method

Maintence: The cash method is easier to maintain because you don't record income until you receive the cash, and you don't record an expense until the cash is paid, where as in the accrual method, you will typically record more transactions.

Maintence: The cash method is easier to maintain because you don't record income until you receive the cash, and you don't record an expense until the cash is paid, where as in the accrual method, you will typically record more transactions.

Cash-basis accounting defers all credit transactions to a later date. It is more conservative for the seller in that it does not record revenue until cash receipt. In a growing company, this results in a lower income compared to accrual-basis accounting.

Do you what is meant by GAAP?

No, I don't know, but knows most of ERP follows these. Lets explain this way:

The word"generally accepted accounting principles" (or "GAAP") consists of three important sets of rules:

(1) The basic accounting principles and guidelines,

(2) The detailed rules and standards issued by FASB(Financial Accounting Standards Board and its predecessor the Accounting Principles Board (APB)

(3) The generally accepted industry practices.

No, I don't know, but knows most of ERP follows these. Lets explain this way:

The word"generally accepted accounting principles" (or "GAAP") consists of three important sets of rules:

(1) The basic accounting principles and guidelines,

(2) The detailed rules and standards issued by FASB(Financial Accounting Standards Board and its predecessor the Accounting Principles Board (APB)

(3) The generally accepted industry practices.

Normally Standard GAAP will have various guided Principal, such as

- Economic Entity Assumption

- Time Period Assumption

- Cost Principle

- Matching Principle

- Revenue Recognition Principle

Will take a seprate case of some of them to understand in better way.

If you want to know more about GAAP, weather US-GAAP, UK-GAAP , refer wikipedia

ERP/Oracle Financials

Oracle Financials have been developed to meet GAAP requirements as well as the special needs of different countries. For example, in Oracle Payables you can choose whether to record journal entries for invoices and payments on an accrual basis, a cash basis, or a combined basis where accrual journal entries are posted to one set of books and cash basis journal entries are sent to a second set of books.

Oracle Financials have been developed to meet GAAP requirements as well as the special needs of different countries. For example, in Oracle Payables you can choose whether to record journal entries for invoices and payments on an accrual basis, a cash basis, or a combined basis where accrual journal entries are posted to one set of books and cash basis journal entries are sent to a second set of books.

By mastering these accounting fundamentals, tech professionals can effectively manage finances, make informed business decisions, and contribute to the success and growth of their companies. Additionally, leveraging accounting software and tools tailored for tech businesses can streamline financial processes and provide valuable insights into financial performance.

ReplyDeleteBest Cash Flow Forecasting Software | Financial Forecasting Strategy | Moolamore Cash Flow Management