OVERVIEW .....

Part one on setup offers a broad view on how AGIS is Setup in R12

The setups are divided into four parts

1. Environmental setups

2. General Ledger (GL) setups

3. Receivable (AR) setups

4. Payables(AP) setups

5. Advanced Global Intercompany System (AGIS)

Part one on setup offers a broad view on how AGIS is Setup in R12

The setups are divided into four parts

1. Environmental setups

2. General Ledger (GL) setups

3. Receivable (AR) setups

4. Payables(AP) setups

5. Advanced Global Intercompany System (AGIS)

Part two on transaction processing discusses the setups those are required for processing the transaction in AGIS

Transaction Processing in AGIS

The summaries of steps those are used for AGIS transaction processing are As follows.

1. Initiation of a transaction by an intercompany organization

2. Completion of accounting from the initiator side

3. Completion of accounting from recipient side

4. Approval of the transaction by the recipient

If the invoicing is opted for, in transaction type setups then,

1. Processing of Invoice from Receivables

(For the initiator subsidiary side)

2. Processing of invoice in Payables

(For the Recipient subsidiary side)

Part three discusses the reports in AGIS and reconciliation features in AGIS

1. Standard reports Available in AGIS

2. econciliation features in AGIS

The setup steps are explained in the subsequent sections, from start to finish

The details of the examples used in this document is as follows,

-Initiator Subsidiary-‘Blink AGIS INV ORG’. This organization is a part of BCR Singapore Legal Entity. This Legal Entity uses 001 balancing segment value. The user that is having access to initiator subsidiary is called BCR_S

-Recipient Subsidiary–‘Blink AGIS INVJ ORG’. This organization is a part of BCR Japan Legal Entity. This Legal Entity uses 002 balancing segment values. The user having access to initiator subsidiary is called BCR_J

PART ONE- AGIS SETUP

Welcome to the Advanced Global Intercompany System (AGIS) setup

Description of the setup that is used in this viewlet is as follows

One ledger called Blink ledger.

Two legal entities under that ledger called BCR Singapore legal entity and BCR Japan legal entity. Two operating units Blink AGIS Singapore OU, Blink AGIS Japan OU respectively.

*Note: Setting up of receivable setup is mandatory, for using invoicing functionality. And for setting up of receivables mandatory that inventory Organization are created as well.

The transactions in this example are assumed to be happening from BCR Singapore to BCR Japan. For theses two create

Two employees: BCR Singapore and BCR Japan

Two Users : BCR_S and BCR_J

Create receivables and GL Responsibilities.

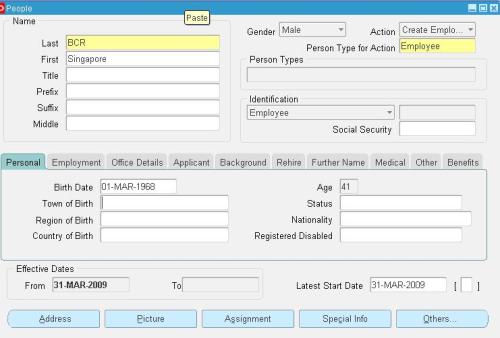

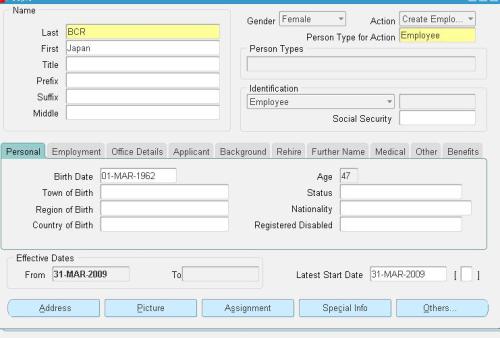

As the first step we should define employees in HRMS. These employees are used later on in the AGIS security setups.

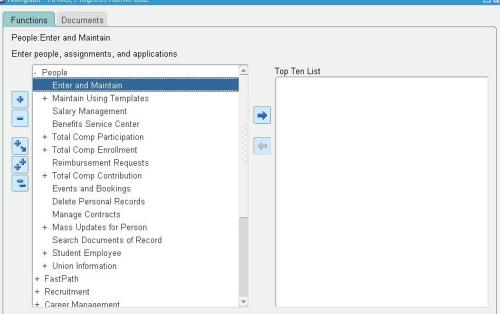

Navigation: HRMS, Progress Admin S&L>>People>>Enter and Maintain

Define an employee ‘BCR, Singapore’ .This person will be attached to the user initiating the transaction in AGIS. In our example transaction gets initiated by BCR Singapore

Similarly create another employee (Recipient) BCR Japan and Save your new creations.

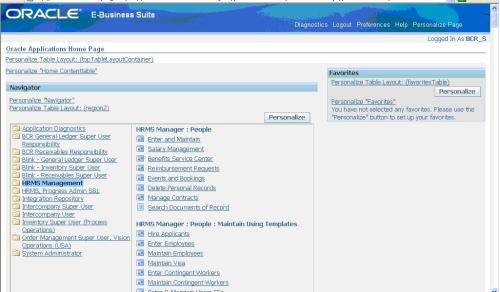

Create a users like BCR_S & BCR_J. Note the Person attached to this User is (BCR, Singapore) he is now the contact Person

Next step is to define Custom responsibilities like GL Super User, AP Super User, AP Super User, HRMS Management, OM, & AGIS Super user Resposibilities and attach it to our users.

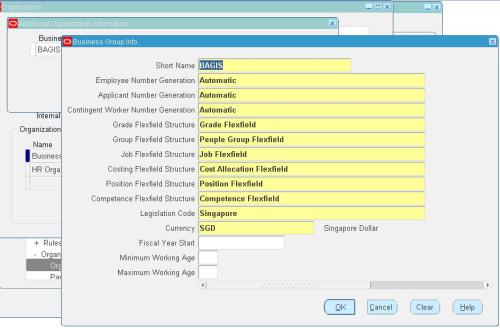

Our next setup in AGIS set id to define a business group

Login to HRMS Responsibility and create Business group called Blink AGIS, Which you will later require to attach with the operating Units.

Navigation:

HRMS Management>>HRMS Manager>>Work Structures>>Organization>>Description

Click on Other button at line Level and set the Business Group settings:

Next step is to set some of the system profile options.

Navigation: System Administrator>>Profile>>System

Profile options where set for

1. HR: Business Group,

2. HR: Security,

3. MO: operating Unit,

4. MO: security profile,

5. MO: Default Operating Unit Profile,

6. GL Ledger name

One might already know, If MO: Security profile is defined the MO: Operating unit profile becomes redundant.

No comments:

Post a Comment